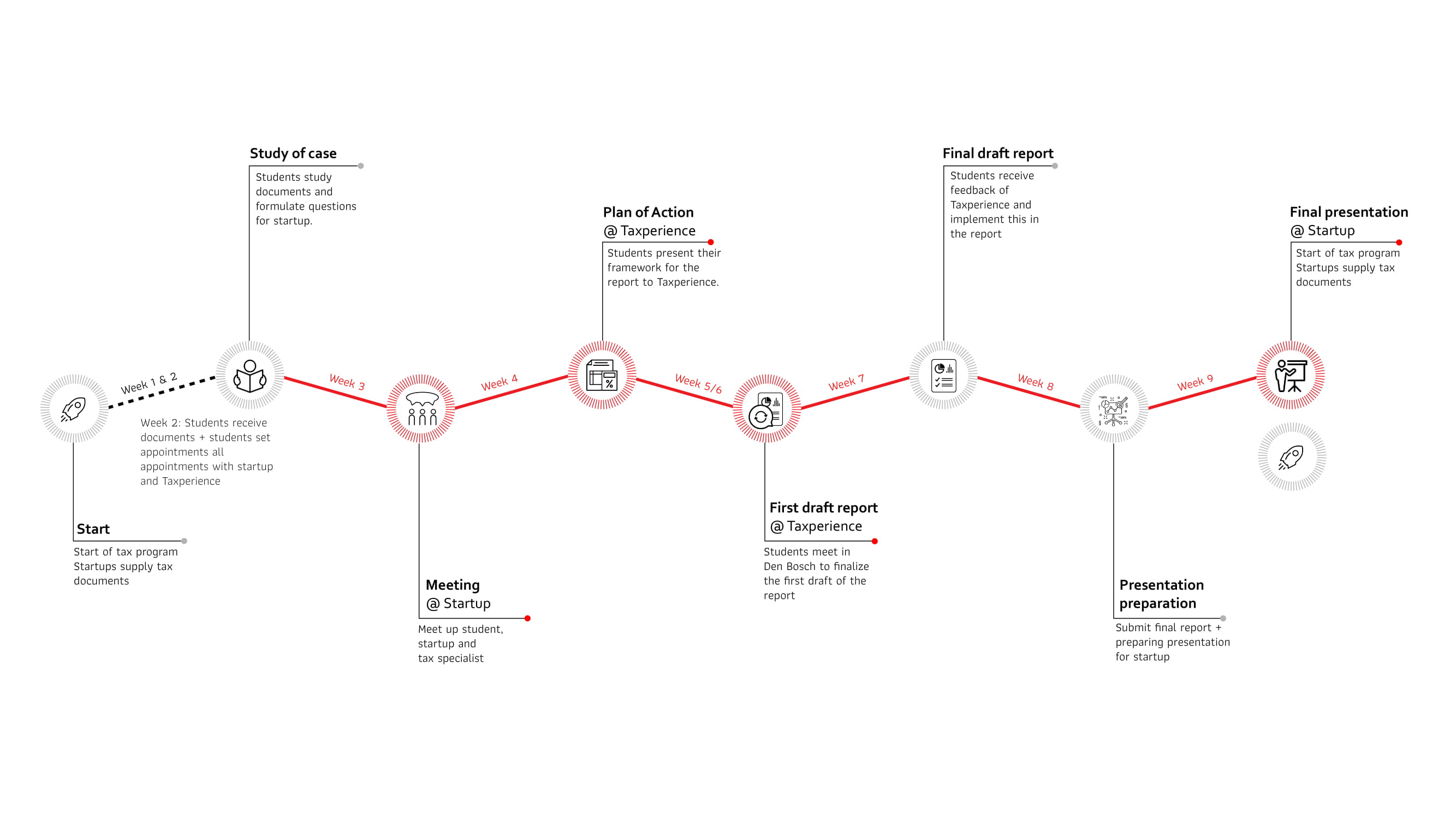

The trajectory

Who will help me?

Taxperience an introduction

Taxperience, started in 2006 and is now firmly anchored in the area of tax, financial and legal services. Our growth is a byproduct of the outstanding client service delivered by our people, the best professionals in the industry. Our objective isn’t to be the biggest firm, it is to provide best-in-class client services in seamless fashion across the globe.

Taxperience supports the vision of the ehvLINC project to help startups getting their tax structure at a professional level. Bas Sonneveldt and Josine Vos will assist the students with performing the tax scan for the start-ups. Bas Sonneveldt is a VAT director with more than 20 years experience in the field of VAT. Josine Vos is a Senior Tax & Transfer Pricing Manager and has experience for more than 12 years with supporting clients in all kind of related direct tax issues (i.e. personal- and corporate income tax, wage tax, corporate structuring etc.) and transfer pricing.

We are looking forward to working with you and helping you getting insight in your current tax position!

The Taxperience team

Josine

Vos

Senior Tax Manager

Diederik

Hauser

Owner & Tax Partner

Bas

Sonneveldt

VAT Director

How do I apply?

How you apply for the program can be found on our Application page Startups and Application page Students

If you have any questions please contact us by sending an email to: application@eindhovenlinc.com

Keep startuping and may the force be with you!

The ehvLINC team